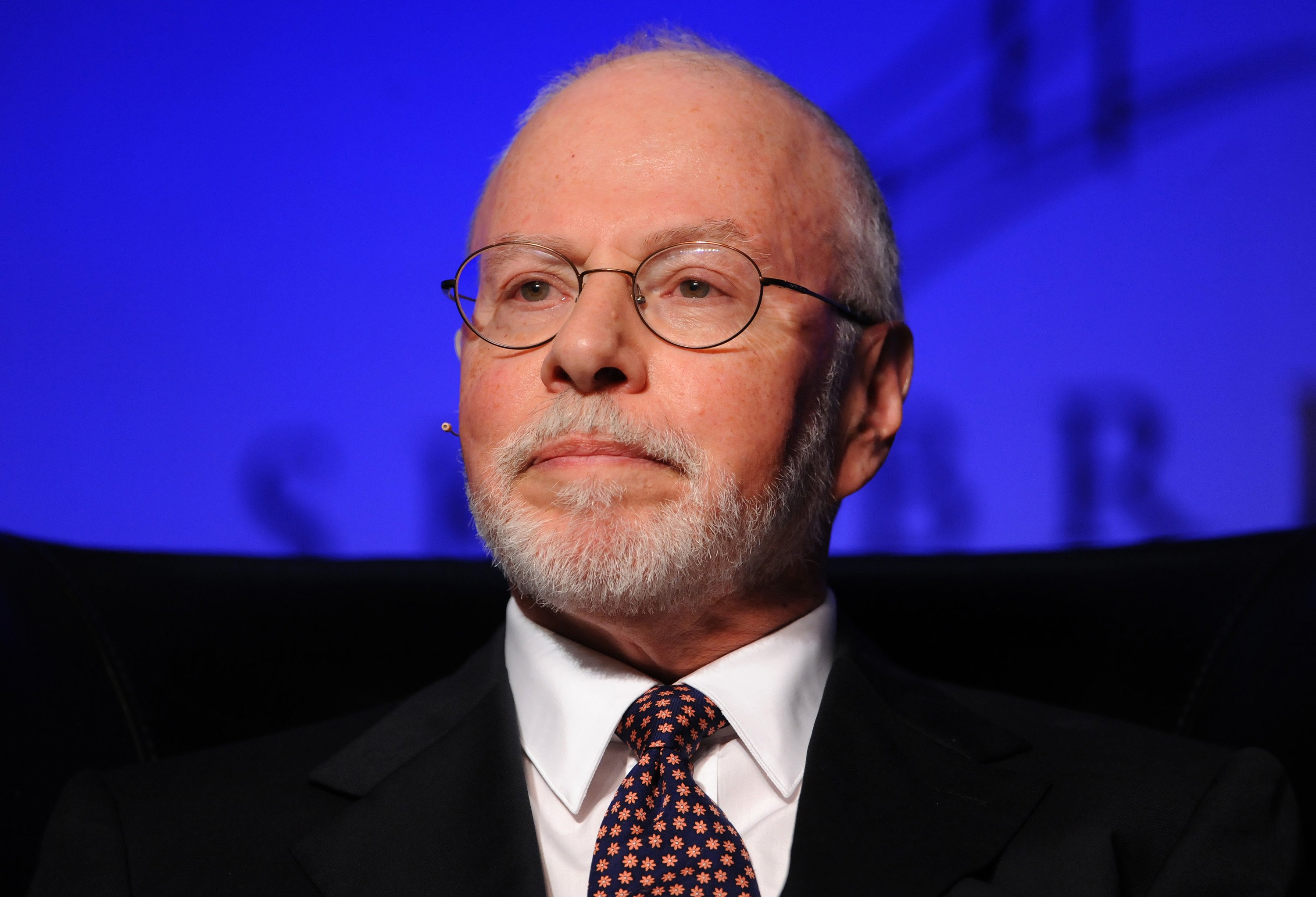

Paul Singer’s Elliott Management Corp., which launched a bitter takeover attempt of Compuware Corp. from 2012-14, is believed to be seeking changes that could include taking Taubman private or a sale, according to Bloomberg, which first reported Elliott Management’s stake in Taubman last week.

- Taubman will face a formidable foe in Elliott

- Activist hedge fund has bought a 3.8 percent stake in the luxury mall giant

- Taubman has been controlled by its founding family for almost 70 years

They've seized an Argentinian warship and picked a fight with Warren Buffett.

But no one outside the two companies knows exactly what Paul Singer's Elliott Management Corp. is seeking from Bloomfield Hills-based Taubman Centers Inc. now that the activist hedge fund has bought a 3.8 percent stake in the luxury mall giant.

Yet one thing is certain: It's likely to be a warpath Elliott marches as Taubman (NYSE: TCO), which has been controlled by its founding family for almost 70 years, battles the New York City-based fund at the same time it faces arrows from another activist investor, Jonathan Litt of Connecticut.

"Singer doesn't care if you hate him. He doesn't care if you hang him in effigy," said Erik Gordon, clinical assistant professor at the University of Michigan Stephen M. Ross School of Business. "His goal is to push companies, and even countries, into making changes that create wealth. That's it. That's all he cares about."

Elliott, which launched a bitter takeover attempt of Compuware Corp. from 2012-14, is believed to be seeking changes that could include taking Taubman private or a sale, according to Bloomberg, which first reported Elliott Management's stake in Taubman last week.

That could even include the eviction of the pioneering mall company's founding family from their namesake company.

For Michael Mazzeo, dean of the School of Business Administration at Oakland University, just the fact that Elliott Management even disclosed its 3.8 percent stake at all when it wasn't legally obligated to — that's not required until a 5 percent stake is achieved — is telling.

"They are signaling that they are in play," said Mazzeo, who specializes in mergers and acquisitions. "While it's not really clear what they are seeking at Taubman, since there are two competing aggressors in this case, that would suggest that this company is undervalued. They may be taken over and then split apart, or they may keep what's good and sell what's bad."

Part of the concern about Taubman, which declined comment for this story, has been that its stock prices haven't reflected its asset performance.

The company's stock has fallen by 21.48 percent in the last 13 months, from $71.17 the day Litt's takeover bid was revealed in October 2016 to $55.88 on Nov. 15, the day after Elliott Management's bid was. To be sure, stock prices for other major mall real estate investment trusts have fallen, substantially underperforming the S&P 500, but not as much as Taubman's, Bloomberg reported.

That's even as the company handily dominates its peers in key performance measurements like sales per square foot; Taubman's malls have $802, while its nearest competitor, Macerich Co., is $659, according to Bloomberg.

"When a company comes in the crosshairs of Elliott and Paul Singer, that company most likely will succumb to Elliott," Sudip Datta, T. Norris Hitchman endowed chair and professor of finance in the Mike Ilitch School of Business at Wayne State University, said in an email.

"He will eventually most likely succeed in this battle, substantially restructure the board and change management. … Taubman may be forced to go private to restructure and then go public again when it gets its act together. There is substantial board and management changes in the cards for Taubman."

Alex Calderone, managing director of Birmingham-based corporate advisory firm Calderone Advisory Group, said Elliott thinks it can do better.

"(Elliott has) formulated an investment thesis that assumes shareholder value will increase by shifting control away from the incumbent leadership team … but we don't yet know what they want," Calderone said. "Is it something short of (CEO, president and board chairman Robert) Taubman stepping down? Do they want the company sold? It's too early to tell."

Beating back outsiders

For the last year, Taubman has also been fighting off investor Litt, who has argued that the company's stock is undervalued compared with the value of its luxury mall assets across the world, as well as its REIT competitors.

His recommendations included halting any major external growth initiatives such as new development; exploration of "management-led privatization or a sale of the company to a third party;" selling assets and buying back Taubman stock; monetizing its Asia business in a joint venture, spin-off company or outright sale; and a sale of the Beverly Center in Los Angeles.

Gordon said Taubman's inability to shake Litt has made the ground fertile for Elliott Management.

"By not taking the heat off that kettle, by letting Litt keep that kettle boiling, Litt has now attracted Elliott, and that's a game changer," Gordon said, adding that he anticipates within a year or two that Elliott will have radically altered Taubman's board and forced the family to sell off a substantial portion of its ownership stake."

Litt, who was not made available for an interview last week, has also argued that the board is too entrenched and lacks diversity.

Since then, Taubman has seated a new board member, Cia Buckley Marakovits, and accepted the resignations of Peter Karmanos Jr. and Graham Allison, who will be replaced by Mayree Clark and Michael Embler.

Karmanos did not return a message last week seeking comment.

Litt's attempt earlier this year to get himself and Charles Elson, director of the John L. Weinberg Center for Corporate Governance at the University of Delaware, on the board failed this summer.

But where Litt fell short, Gordon says Elliott Management will prevail.

"Out of Taubman's top 10 institutional investors, Elliott's going to have worked with 10 of them," he said. "He has the power, the guts and he also has the reputation with them. They listen very carefully when Singer talks."

Taubman, under family control since A. Alfred Taubman started the company in 1950, has withstood outsiders before — in one case, with an assist from Lansing.

In 2003, Taubman thwarted a hostile takeover attempt by Simon Property Group, the largest U.S. shopping mall owner, and Westfield America Inc. to buy Taubman for $4.25 billion, or $20 a share.

The Taubman family resisted the Simon Property Group/Westfield buyout, a move which was aided by an amendment to Michigan law signed by Gov. Jennifer Granholm on Oct. 7, 2003, that prompted the companies to withdraw their offer the following day.

The family maintains control of the company through about 25 million shares of Series B Preferred Stock, which gives it about 30 percent of the shareholder vote.

But that control is the subject of Litt's federal lawsuit, which alleges the family owns 29.3 percent of voting shares, while the charter restricts ownership at 8.23 percent. It's unclear how many shares each individual family member owns.

"I believe that even with Taubman family's 30 percent ownership, Paul Singer will have a very good chance to make the changes to turn around this poorly performing real estate company. My money is on Elliott," Datta said.

The warship repossession

Elliott has a history of high-profile scuffles, some of international magnitude. Elliott spent 15 years trying to wrangle billions from the South American country of Argentina for lapsed debt payments.

The tactics Elliott employed included attempts to overtake contracts between the government and Elon Musk's SpaceX program and the seizure of an Argentine Navy ship pulled into port in Ghana in 2012.

The hedge fund convinced a Ghanaian court to seize the three-mast vessel as an avenue to collect on its debt. The maritime court eventually released the ship after two months of court battles.

The Argentine government eventually agreed last year to a settlement to pay Elliott $2.4 billion for its bond obligations, The Washington Post reported in March 2016. Elliott had acquired the bonds more than a decade earlier for $117 million.

Calderone said right or wrong, Elliott usually gets what it wants.

"This situation (at Taubman) is likely to become highly contentious, but Elliott is no stranger to operating in that type of an environment," Calderone said. "This is everyday business for Elliott, and while I think it's too early to know what this might mean for the Taubman family, the one thing I know for sure is there is going to be one hell of a fight."